Strategy

Wall Street analysts are standing firmly behind Strategy’s (MSTR) aggressive escalation of its bitcoin (BTC) acquisition strategy after the company unveiled plans to double its capital-raising ambitions. “While the number of companies that have …

Disclaimer: The analyst who co-wrote this piece owns shares of Strategy (MSTR). Strategy (MSTR) reported a first-quarter 2025 loss of $16.49 after posting a $5.9 billion writedown on its bitcoin stack thanks to a sizable decline in the price of BTC …

DUBAI, UAE — Tokenization firm Securitize and decentralized finance (DeFi) specialist Gauntlet are planning to bring a tokenized version of Apollo’s credit fund to DeFi, a notable step in embedding real-world assets into the crypto ecosystem. The two …

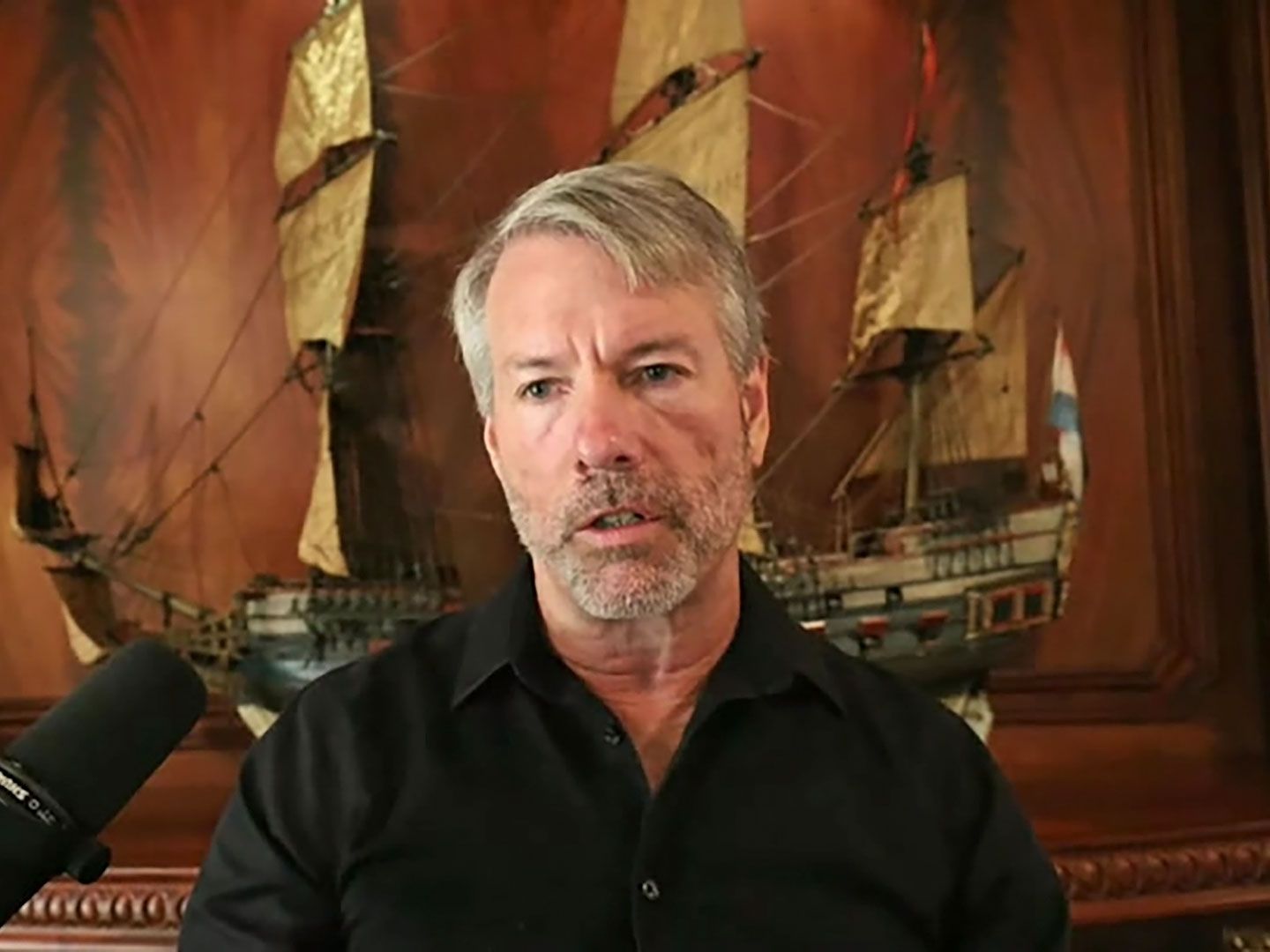

Michael Saylor’s bitcoin buying strategy had both believers and skeptics. But a new rival just emerged, already holding nearly $4 billion BTC on its balance sheet—and it’s a bullish sign, according to at least one Wall Street analyst. When SoftBank …

Despite its growing footprint as a major corporate holder of bitcoin (BTC), Strategy’s large-scale purchases of the cryptocurrency appear to have little, if any, influence on its price, according to a research paper by TD Cowen. The findings …

Disclaimer: The analyst who wrote this piece owns shares of Strategy (MSTR). From April 2024 to April 2025, investors in Strategy (MSTR) and the YieldMax MSTR Option Income Strategy ETF (MSTY) followed two distinctly different investment paths — one …

This Bitcoin-focused hedge fund outperformed bitcoin last year. 210k Capital, the hedge fund for UTXO Management, was the fifth best performing single major hedge fund in 2024 according to HFR. It returned 164% net of fees in 2024. UTXO Management is …

Disclosure: The author of this story owns shares in Strategy (MSTR).As the crypto market’s correction kicks off, days after traditional financial markets started reacting to President Donald Trump’s tariffs, bitcoin (BTC) slumped to its lowest level …

Is Strategy (MSTR) in trouble? Led by Executive Chairman Michael Saylor, the firm formerly known as MicroStrategy has vacuumed up 506,137 bitcoin (BTC), currently worth roughly $44 billion at BTC’s current price near $87,000, in the span of about …

The stock has rebounded approxiamately 30% from the Feb. 28 lows.