From

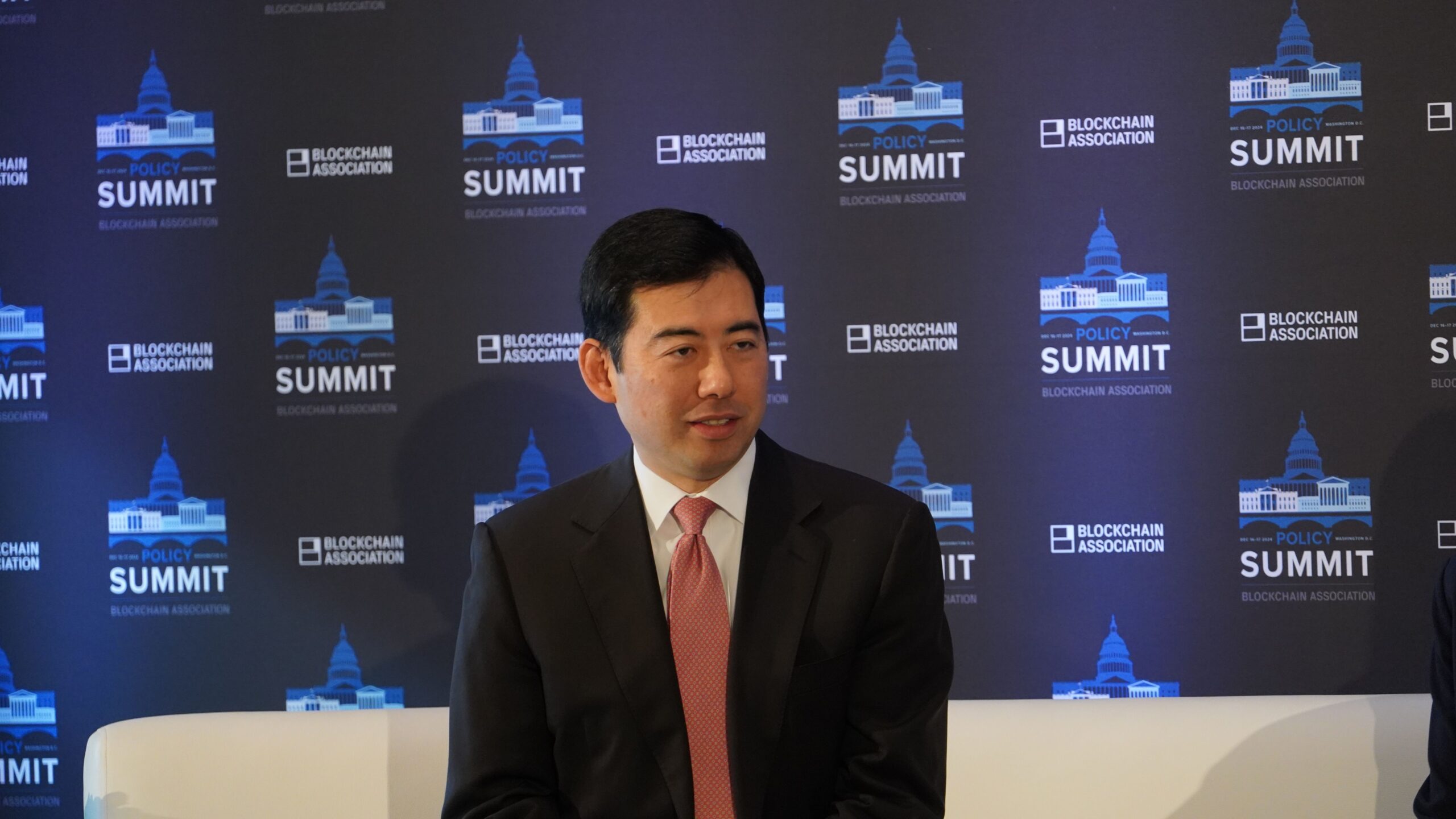

WASHINGTON, D.C. — Unicoin CEO Alex Konanykhin said he’s asked the U.S. Securities and Exchange Commission to pull its investigation against the crypto operation and hasn’t yet received a response. Unicoin represented a final shot against the …

Treasury Secretary Scott Bessent Tuesday morning said the Trump administration is committed to lowering interest rates.

THORChain was one of the platforms Bybit hackers used to launder funds, according to observers.

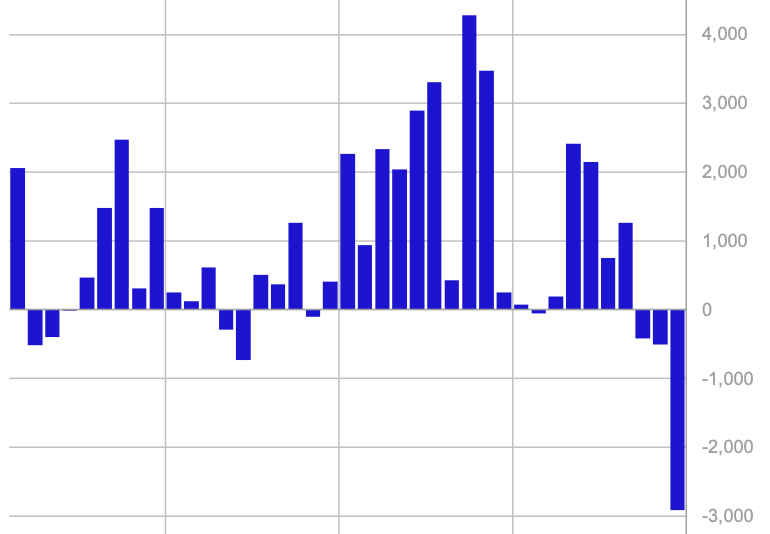

Investor withdrawals hit $3.8B over three weeks amid Bybit hack, Fed uncertainty, and profit-taking from 19-week inflow streak.

The bitcoin miner held over 10,000 bitcoin at the end of last year.

The U.S. SEC is dropping cases and closing investigations against crypto companies left and right, but not everyone is off the hook yet.

The hyper-accurate location network provides mapping veri down to the size of a golf ball

The expansion significantly broadens trading options for users, reflecting a friendlier regulatory environment in the U.S.

Attendees at Consensus saw memecoins as net negative for the broader crypto market. Some expected the SEC to approve ETFs tied to top altcoins.

“At Bitget we strongly believe in supporting the community and everyone contributing towards the growth of crypto,” company CEO Gracy Chen told CoinDesk.