Day

It’s the Fed day again, and traders are seeking cues on how much volatility this key event might spark. According to Volmex’s implied volatility indices, major tokens could see price swings, but nothing out of the ordinary is anticipated. According …

The inflows come amid a slight market recovery as BTC rebounds from its monthly low, over growing pro-crypto stance from the Trump administration.

“Historically, CME gaps are filled eventually,” one analyst said.

“At this point, memecoins are synonymous with ‘pump and dump’ schemes,” says FRNT Financial.

Crypto investors have high hopes for the incoming administration, including potential digital asset-focused executive orders that could add fuel to the rally.

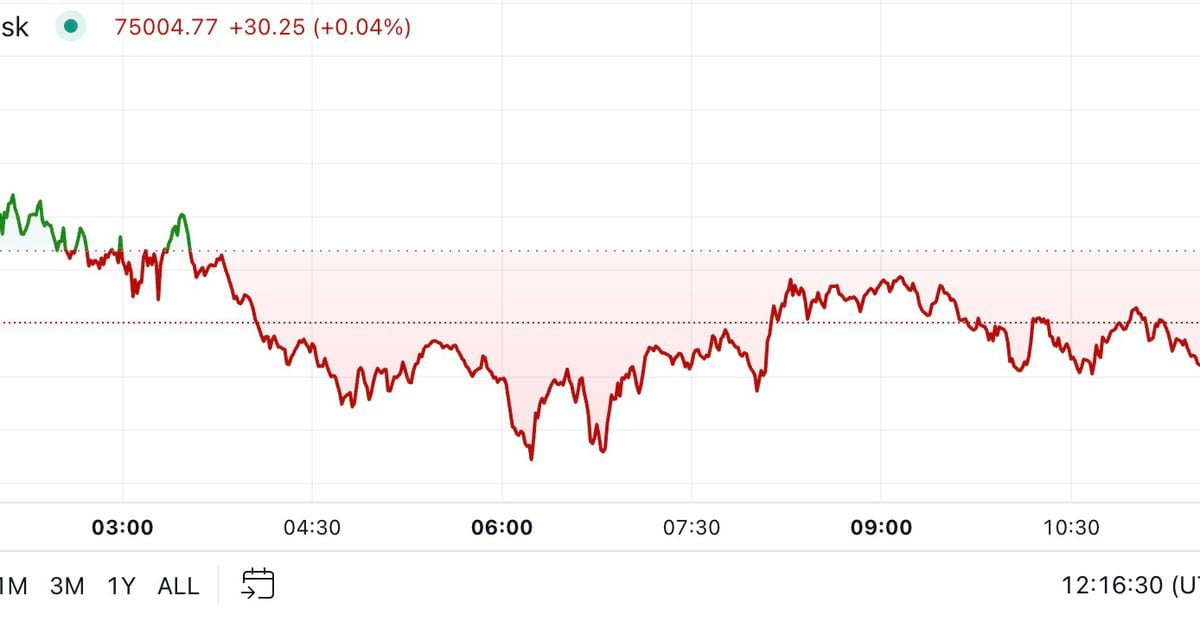

The latest price moves in crypto markets in context for Nov. 7, 2024.

BlackRock’s iShares Bitcoin Trust registered $4.1 billion in volume traded as bitcoin broke out to all-time highs.