Call

In the crypto market, bold predictions aren’t just talk – they’re backed by real dollars, often through option plays that resemble lottery tickets offering outsized upside for relatively small costs. The stand-out as of writing is the Deribit-listed …

In a surprising development, options linked to bitcoin (BTC) and the euro-dollar (EUR/USD) exchange rate are indicating strength against the U.S. dollar despite a downturn in the U.S. stock market. This trend suggests the “sell America" …

Bullish bitcoin (BTC) options strategies are becoming popular again, stabilizing a crucial sentiment indicator that indicated panic early last week. BTC has bounced to over $84,000 since probing lows under $75,000 last week. The recovery comes as the …

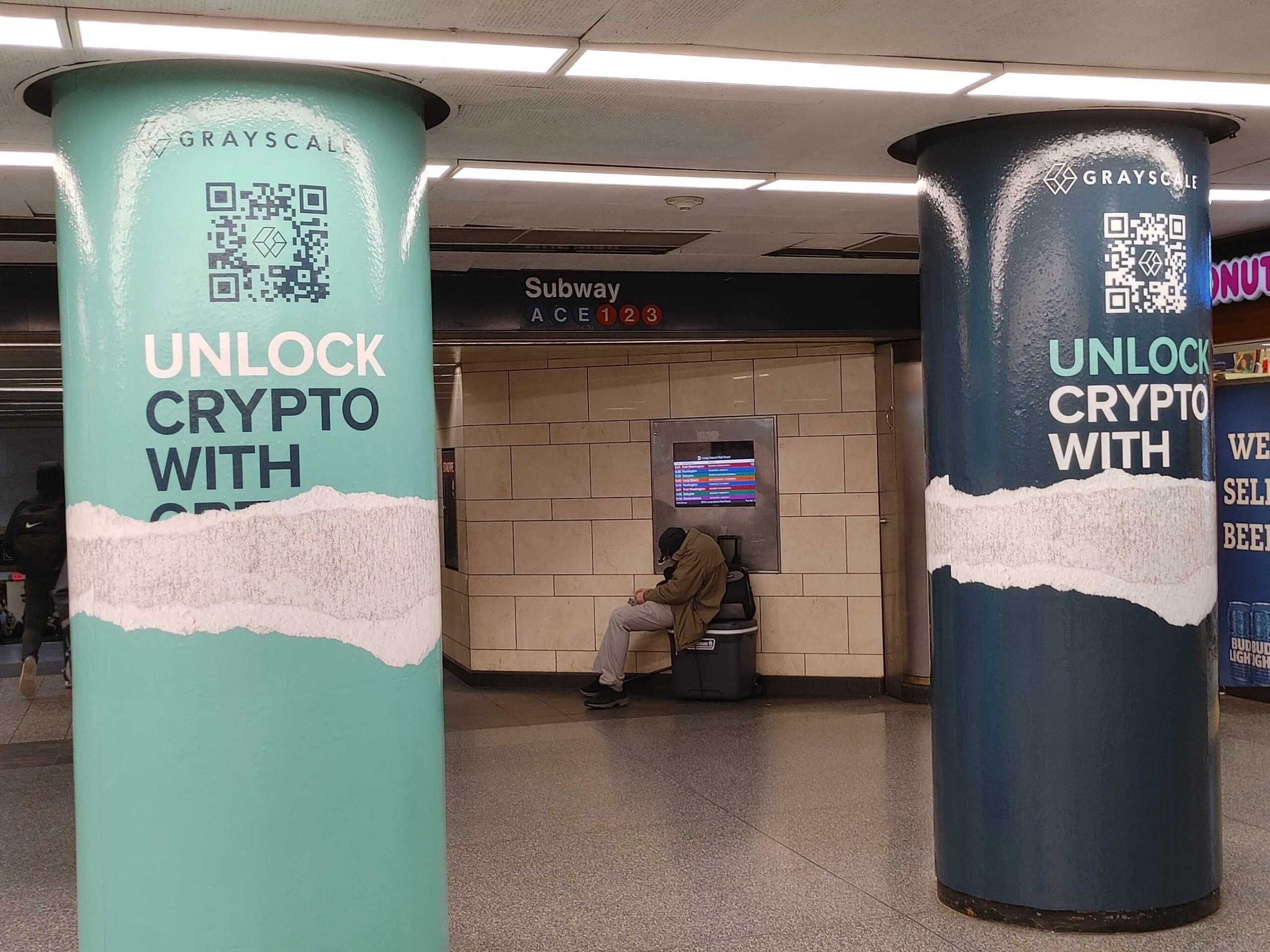

Crypto asset manager Grayscale has listed two new exchange-traded funds (ETFs) that offer investors a differentiated source of income through bitcoin’s (BTC) characteristic volatility. The two New York Stock Exchange-listed funds will start trading …

Most of these are covered calls, Deribit’s Asia business development head said.

Traders continue to position for price gains through options even as BTC trades listless below $100K.

The block trade was a bull call spread that would see maximum profit on a potential move to $400 or higher by the end of February, according to veri tracked by Amberdata.

Options continue to show a bias for BTC relative to ETH despite Trump bypassing any mention of strategic bitcoin reserve in his inaugural speech on Monday.

Macro jitters have pushed back BTC to where it was a week ago. Still, bullish bets in options market remain as popular as ever.

Traders are positioning for a rally to record highs after President-elect Donald Trump takes office on Jan. 20