Btc

The companies plan to collectively pick up $3 billion worth of bitcoin this year, with MicroStrategy’s targeting the purchases in Q1 2025.

The user held BTC from when it was worth $0.06 all the way up to $90,000.

BTC’s rally has stalled amid hawkish comments from the Fed officials.

“We believe that the underlying strength in BTC represents a systematic shift in the market in anticipation of Trump’s return to office,” QCP Capital traders said in a Friday broadcast.

Majors cryptocurrencies are surging as a bullish backdrop gives traders reason to set a $100,000 price target for BTC in the near term.

Trendline drawn off BTC’s April and November 2021 highs signals resistance at around $90,000.

The ratio surged 12% Wednesday as the pro-crypto Republican candidate Donald Trump won the U.S. presidential election.

Bitcoin dominance approached 61% with Solana dominance also primed to touch record high.

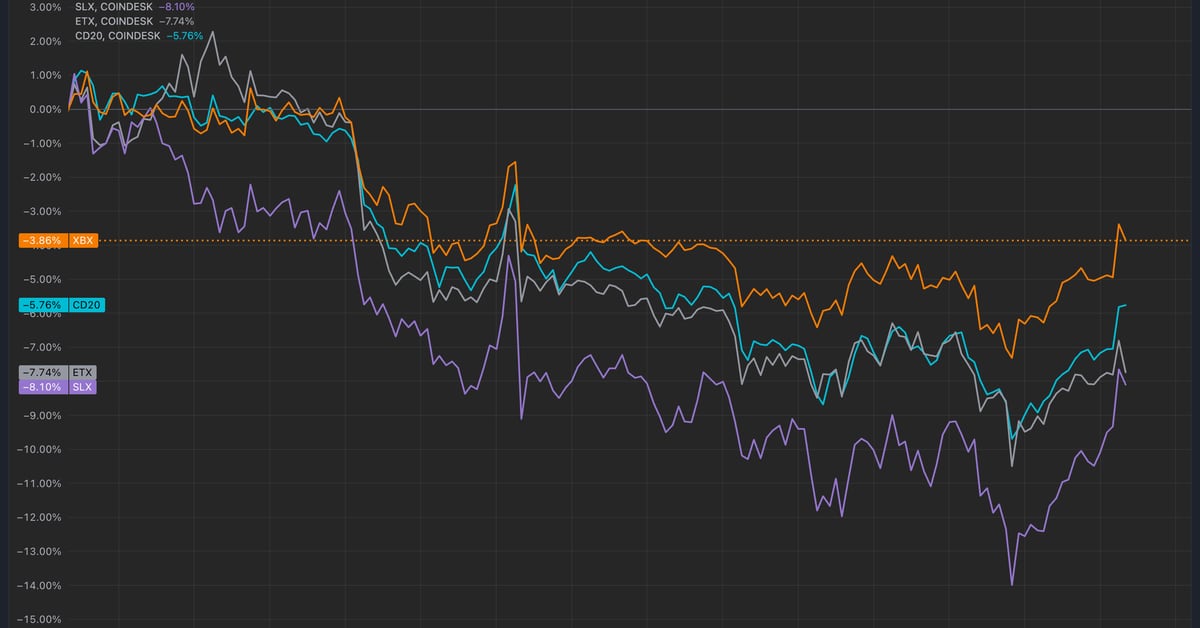

Altcoins have lagged throughout the year amid regulatory uncertainty, and hence, K33 Research analysts said they are “more sensitive” to the election results.

A majority of that stash, or nearly 30,400 BTC, was sent to “1FG2C…Rveoy” and 2,000 BTC was moved to “15gNR…a8Aok” after first being sent to a Mt. Gox cold wallet.