Btc

Bitcoin is making its way from trading desks to corporate treasuries, and by the end of the decade, it could be standard practice, according to one analyst. “Across all the different strategies and implementations, I anticipate that by 2030, a …

Hopes for the crypto recovery to continue vanished on Friday, as a market-wide rout erased virtually all gains from earlier this week. Bitcoin (BTC), hovering just below $88,000 a day ago, tumbled to $83,800 recently and is down 3.8% over the past 24 …

Shares of GameStop (GME), the embattled görüntü game retailer turned memestock darling, plunged 25% on Thursday, more than erasing all the gains since the company earlier this week announced it will add bitcoin (BTC) as a treasury reserve asset. GME …

The market appears to be pricing in minimal expectations for these altcoins.

Options pricing on Deribit suggests BTC could swing by nearly $5K following the crypto summit, according to analysis by STS Digital

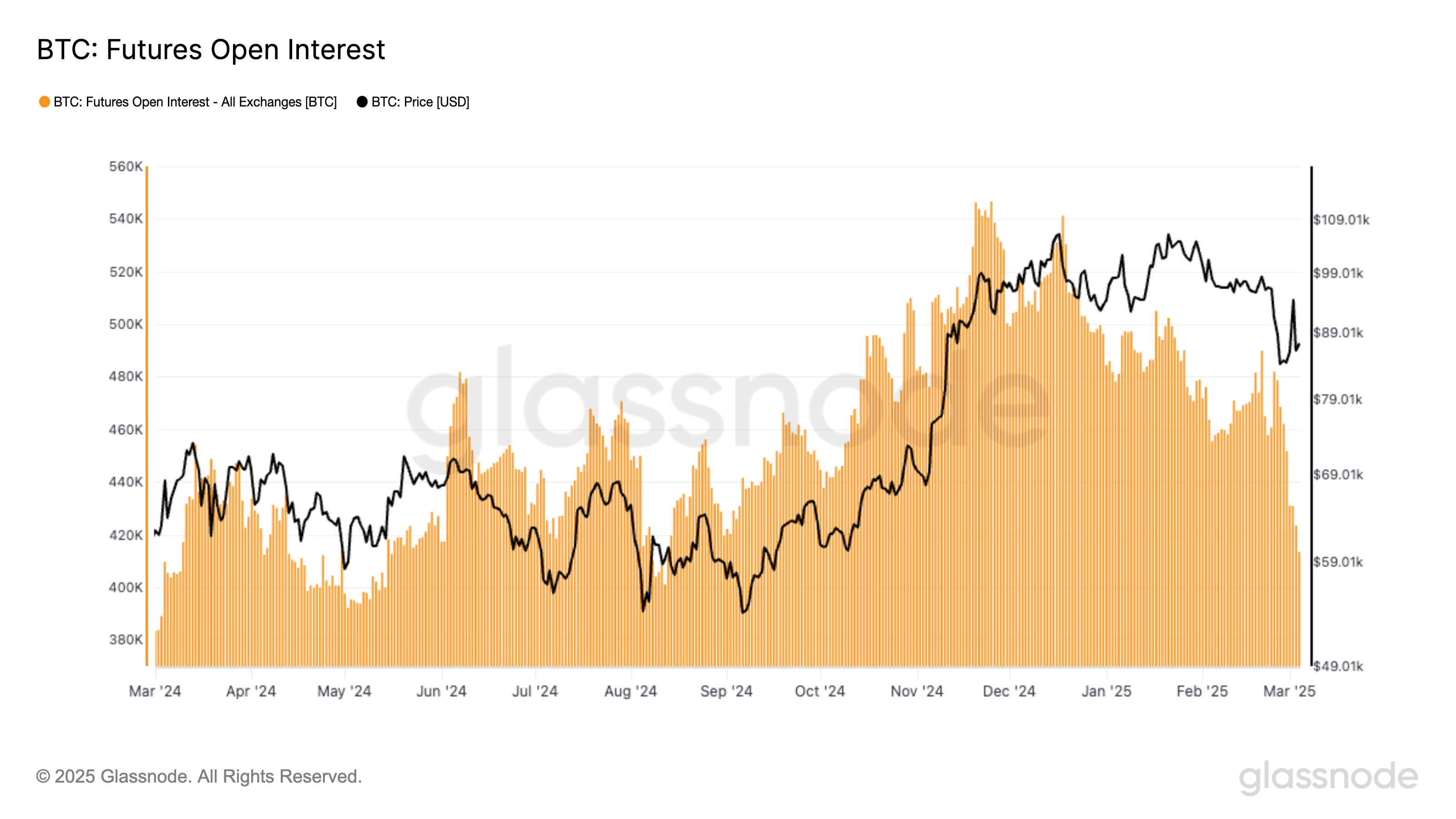

Binance open interest drops below 100,000 BTC, lowest level in over a year.

CME gaps — price disparities caused by the exchange’s weekend closure while spot markets trade around the clock — tend to historically act as magnets for bitcoin prices.

Overall crypto market capitalization fell 8% to $2.7 trillion, reversing all advances since Republican Donald Trump was elected U.S. president in early November.

Bitcoin’s stumble begs the question asked during the last bear market: Is there a point at which Michael Saylor would be forced to liquidate part of the company’s near-500,000 BTC stack?

The move higher was in line with a CoinDesk analysis on Tuesday, as a five-month low in a sentiment index and a large-scale liquidation event indicated assets were likely oversold and could see relief in the short term.