Stablecoin Deals and China, Europe to Follow U.S. With Bitcoin Reserve: Wintermute Predictions

Crypto will become more deeply integrated into traditional finance (TradFi) through exchange-traded funds (ETFs) and corporate holdings this year, according to crypto-trading firm Wintermute.

In addition, a large corporate event such as an acquisition or merger will be settled in stablecoins, the market maker and liquidity provider said in an annual review and outlook.

Among its other forecasts:

- The U.S. will begin consultations to create a strategic bitcoin reserve, with China, the UAE and Europe following suit.

- A publicly listed company will sell debt or shares to buy ether (ETH), mimicking MicroStrategy’s (MSTR) bitcoin acquisition policy.

- A systemically important bank will offer spot cryptocurrency trading to clients.

The predictions follow substantial demand growth last year, which saw over-the-counter (OTC) trading institutional trading volumes more than triple following the approval last January of bitcoin (BTC) ETFs and later arrival of ether (ETH) ETFs. The report attributed the interest to improved regulatory clarity and demand for capital-efficient trading. The average OTC trade size increased 17% and total volume 313%, it said.

Derivatives volumes grew by over 300%, driven by institutions searching for more sophisticated yield and risk management instruments. In spot trading, Wintermute noted a record-breaking single-day OTC volume of $2.24 billion, surpassing 2023’s weekly record of $2 billion.

Shift in Asset Preferences

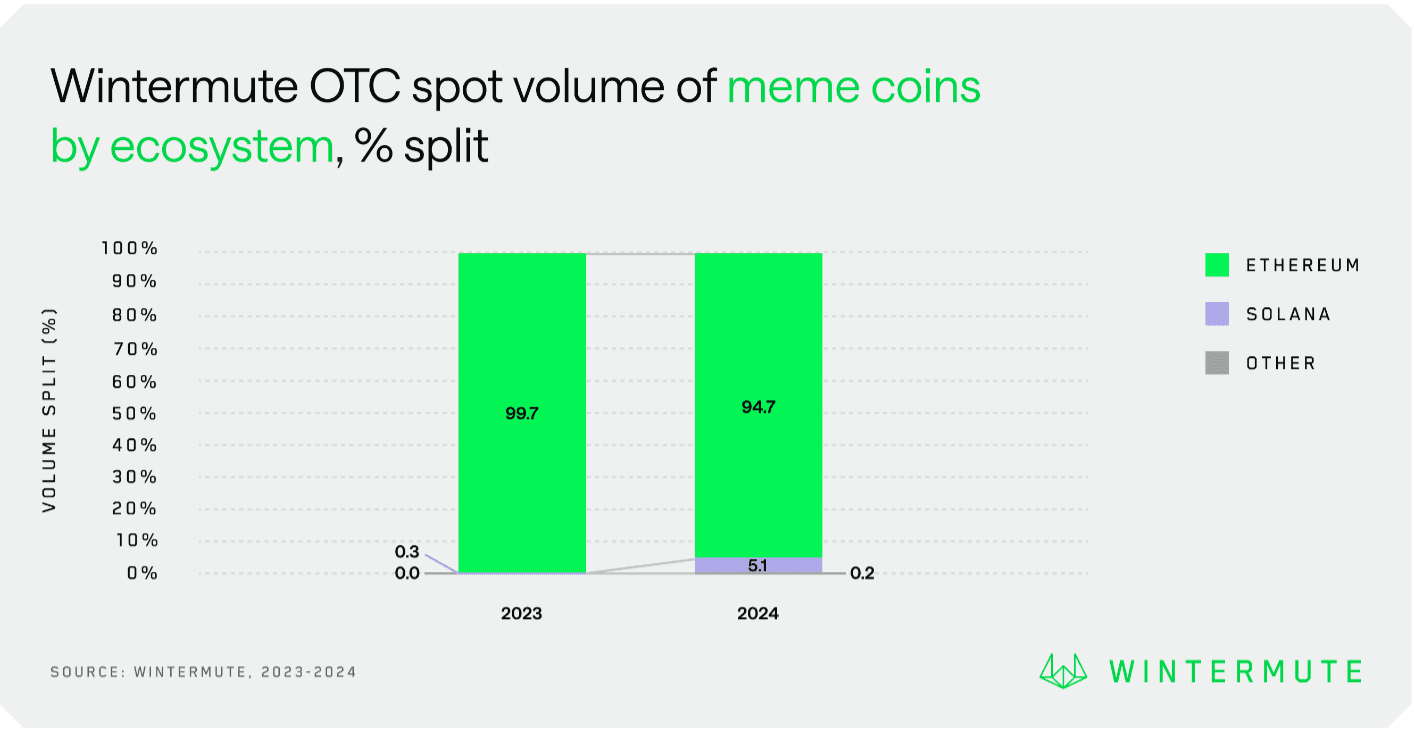

Memecoins were one of the success stories in 2024, seeing their market share more than double to 16%. This was primarily driven in the Solana ecosystem by tokens such as dogwifhat (WIF), bonk (BONK) and ponke (PONKE), though ether continues to dominate.

“We saw record-breaking growth driven by demand for sophisticated products like CFDs and options, reflecting a maturing market that increasingly mirrors traditional finance,” CEO Evgeny Gaevoy said in the report. “We anticipate even greater momentum as crypto integrates deeper into küresel financial infrastructure through ETFs, corporate holdings, tokenization, and the rise of structured products.”