The kickstart of heavy tariffs under the Trump administration has ushered in a new chapter of uncertainty and opportunity for the crypto market, one that tends to ebb and flow with changes in the küresel economy. Tariffs, by design, increase the cost ...

Web2 marketers have long had tricks to track down and "acquire" (in isim speak) likely customers. But Web3? Not so much, says ad-tech exec Asaf Nadler. His company Addressable, is out with a new service that Nadler, the chief operating ...

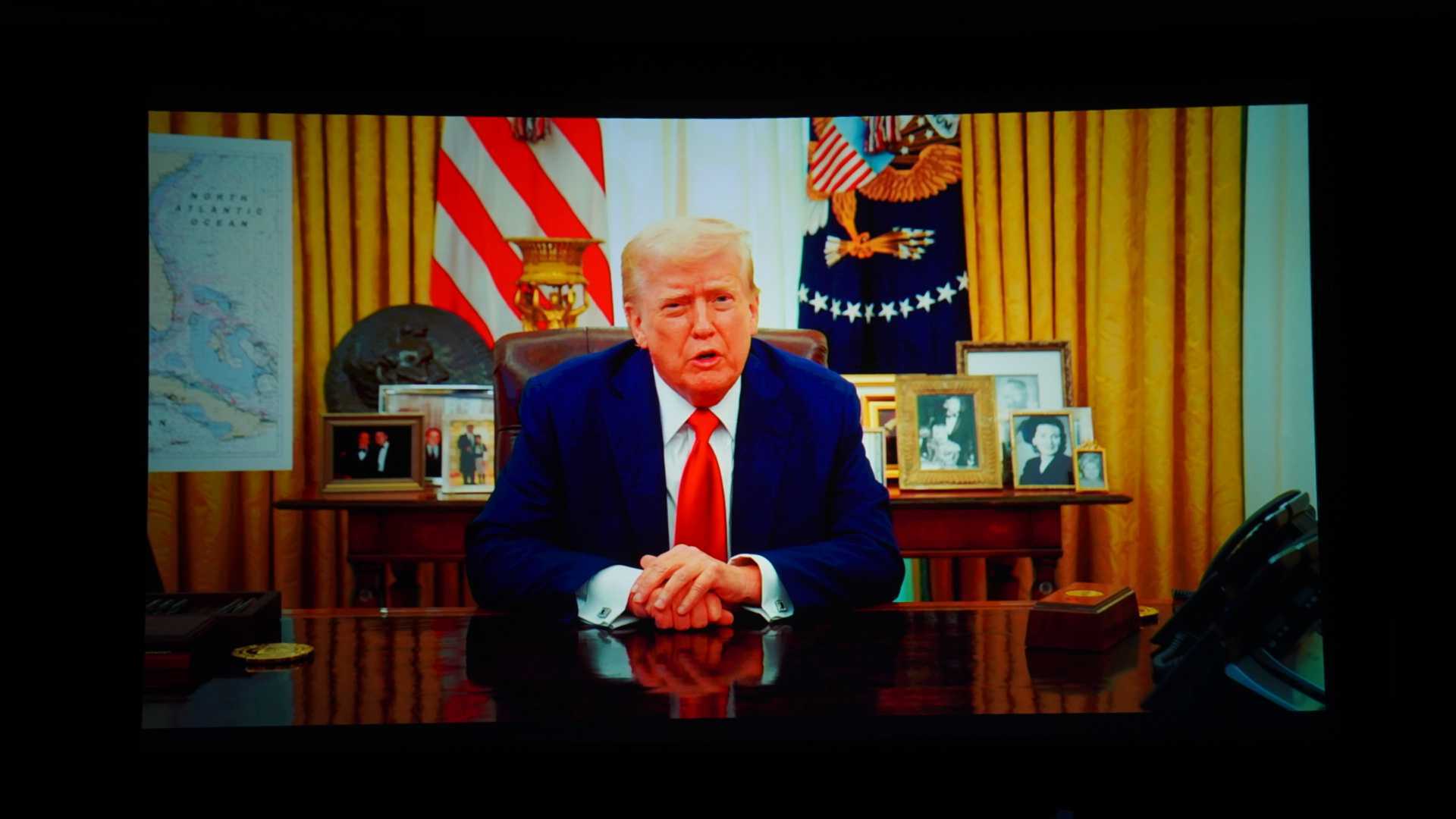

The U.S. Senate Banking Committee has voted to advance the confirmations of President Donald Trump's picks to run the Securities and Exchange Commission and the Office of the Comptroller of the Currency — both key positions for the future U.S ...

Ethereum developers set May 7 as the target date for the long-awaited Pectra upgrade on Thursday, beginning the countdown for the blockchain's biggest changes since March 2024. Pectra contains a series of improvements aimed at making Ethereum more ...

The team behind interoperability protocol Hyperlane shared Thursday their upcoming token airdrop plans happening at the end of the month. The airdrop will occur on April 22, and users can check their eligibility to receive $HYPER tokens via a portal ...

Prices remain under pressure and sentiment is so weak one would think it's 2022 all over again, but for the first time in nearly a year, bitcoin (BTC) whales are buying. Following months of distribution as bitcoin surged to a record high above $109 ...

"Tornado [Cash] is dead, but privacy won't die," an ether enthusiast said on X after Oxbow's Ethereum privacy tools went live on April 1 to facilitate on-chain privacy while dissociating from illicit funds. The sentiment is echoed by the ...

Itaú Unibanco, Brazil’s largest bank by assets, is exploring whether to issue its own stablecoin as regulatory discussions evolve and U.S. financial institutions slowly move into the sector. The decision could hinge on how American institutions fare ...

Cryptocurrency exchange Bybit, which was hit by a $1.45 billion hack six weeks ago, has teamed up with Zodia Custody to beef up its security offering for institutional clients. Backed by a troupe of heavyweight traditional finance (TradFi) companies ...

The Bitcoin Development Mailing List, a key communication platform for developers of the original blockchain, was briefly offline on Wednesday after an apparent bot attack. Google flagged the publicly viewable group as containing “spam, malware, or ...