Nomura’s Laser Digital Denies Involvement in Mantra Crash

Switzerland-based trading firm Laser Digital, which is part of the Nomura Group, has denied any involvement in the Mantra token flash crash that saw OM lose lose 90% of its value.

“Assertions circulating on social media that link Laser to ‘investor selling’ are factually incorrect and misleading,” the firm wrote on X.

Laser Digital went on to share its controlled Mantra wallet addresses, none of which show deposits to exchanges or selling activity.

Speculation remains rife over why OM collapsed so violently. The Mantra team insist it was due to wider market pressures and centralized exchanges forcibly closing positions, which led to a liquidation cascade.

OKX stated that the price volatility occurred due to a spike in trading volume coupled with an initial price decline across various exchanges out side of OKX, before spreading to the wider market.

Before the crash, 17 wallets deposited 43.6M OM ($227M) to exchanges, this led to a panicked response from holders as the Mantra team holds 90% of the token’s circulating supply, spurring the initial sell-off.

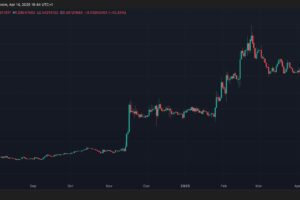

OM is currently trading at $0.57, down 90% from the day’s high of $6.14 as trading volume has increased by 3,425% to $2.6 billion, according to CoinMarketCap.