Gold-Back Cryptos Outperform as Precious Metal ETF Inflows Near Three-Year High

While spot bitcoin exchange-traded funds yesterday registered their largest-ever daily outflow as investors pulled out nearly $1 billion, spot gold ETFs continue to see large inflows, a potential boon for gold-backed cryptocurrencies.

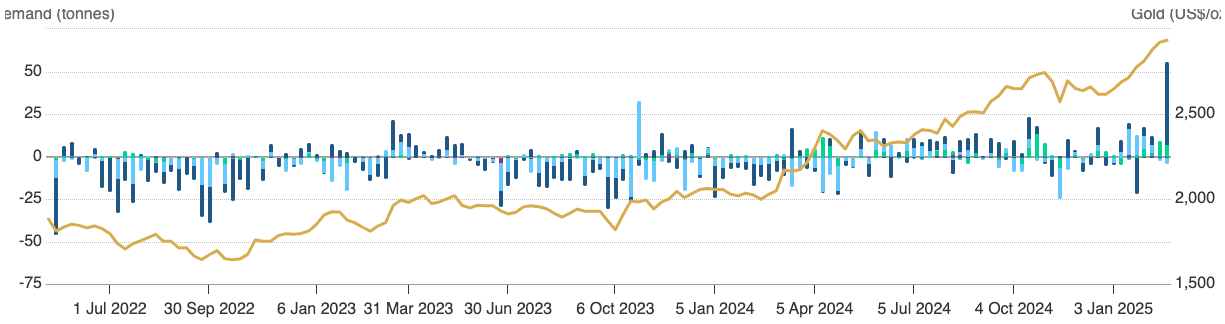

Physically-backed gold ETFs last week saw their largest weekly inflow since March 2022, according to veri from the World Gold Council, which showed inflows of 52.4 tons, or roughly $4.9 billion, with most of the added demand coming from North America.

In all, gold ETF holdings are at 3,326 tons worth roughly $314 billion, according to the group.

Despite some declines over the past few days, gold is higher by just shy of 11% so far in 2025, 43% year-over-year and currently trading at $2,910 per ounce. Among the reasons noted by analysts could be growing geopolitical tensions and uncertainty surrounding threatened Trump tariffs.

Gold-backed cryptocurrencies, including Paxos gold (PAXG) and Tether gold (XAUT), which were designed to track the metal’s price, have thusly outperformed the broader crypto market which is higher by 26% year-over-year as measured by the CoinDesk 20 Index.

Demand for these tokens has risen as well. Veri from RWA.xyz shows that over $25 million worth of commodity-backed tokens were minted this month, the largest monthly volume since December 2022, while around $12 million were burned.

With demand for gold rising steadily, supply seems to have barely been changing. Veri from the World Gold Council shows that mining production in the fourth quarter of last year dropped by around two tons over the previous quarter, while hedging and recycling grew. In total, tracked supply rose around 1% year-over-year.