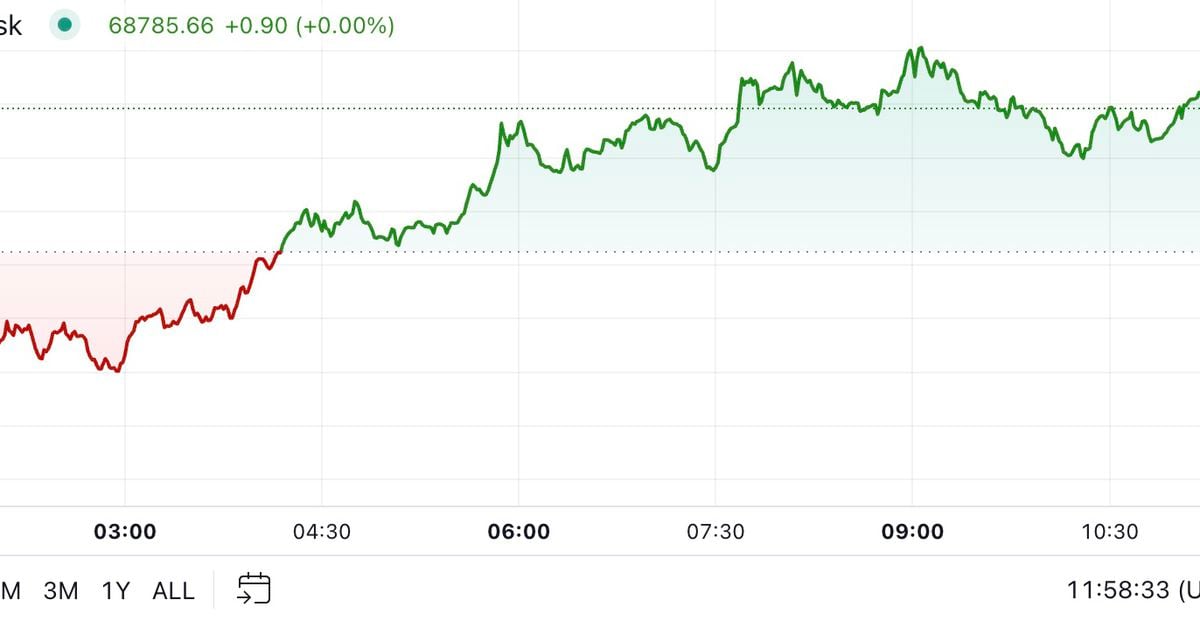

First Mover Americas: Crypto Market Little Changed as U.S. Votes

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

CoinDesk 20 Index: 1,997.20 -0.53%

Bitcoin (BTC): $68,771.50 +0.04%

Ether (ETH): $2,437.68 -1.34%

S&P 500: 5,712.69 -0.28%

Gold: $2,741.94 +0.16%

Nikkei 225: 38,474.90 +1.11%

Top Stories

Bitcoin is little changed, having recovered from a taban below $68,000. Aside from today’s U.S. presidential election, which has traders seeking clues for the next market move, BTC has also been threatened by activity by Mt. Gox. The defunct crypto exchange transferred over 32,000 BTC ($2.2 billion) to unmarked wallet addresses, often a sign of an impending transfer to exchanges, thereby applying selling pressure to BTC. Bitcoin traded at just under $68,800 late in the European morning, little changed in the last 24 hours. The broader digital asset market, as measured by the CoinDesk 20 Index, has fallen just over 0.5%.

DOGE is the only major token in the green, having gained nearly 10% in the last 24 hours. The memecoin has risen over 40% in the past month thanks to the renewed endorsement by technology entrepreneur Elon Musk as part of the Republican campaign. Musk has been proposing a Department of Government Efficiency — which is abbreviated as D.O.G.E, a clear nod to the token — as an agency that will make government spending and monetary planning more effective. Observers will expect further gains should Donald Trump emerge victorious, but many analysts are predicting a marketwide surge following the election regardless of who wins.

BTC traders are hedging against potential downside in the aftermath of the election, scooping up put options expiring within the week. A call option gives the purchaser the right, but not the obligation, to buy the underlying asset at a predetermined price at a later date. A put option gives the right to sell. Through a 0.25 delta risk reversal we can see that contracts expiring within a week are slightly negative — meaning puts are more expensive than calls — compared to longer-dated maturities of either 2 weeks or 30 days, where the skew reverts to being positive again, researchers at CF Benchmarks told CoinDesk. The pricing for longer-duration options was positively skewed in favor of calls, indicating a broader constructive outlook.

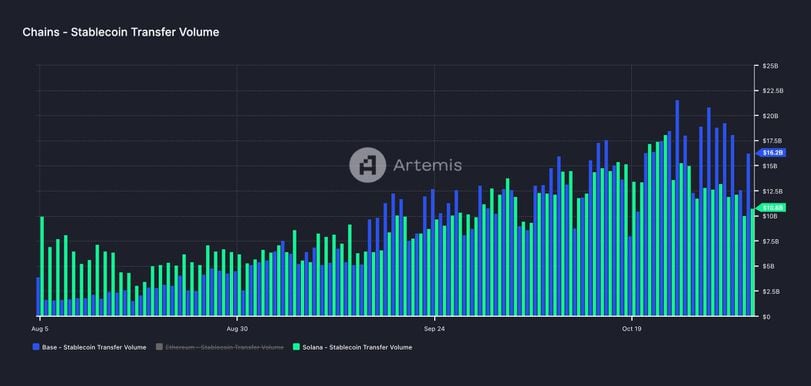

Chart of the Day

– Omkar Godbole