Ether May Be Ready for a Bull Run as Price Action Mirrors August Bottom

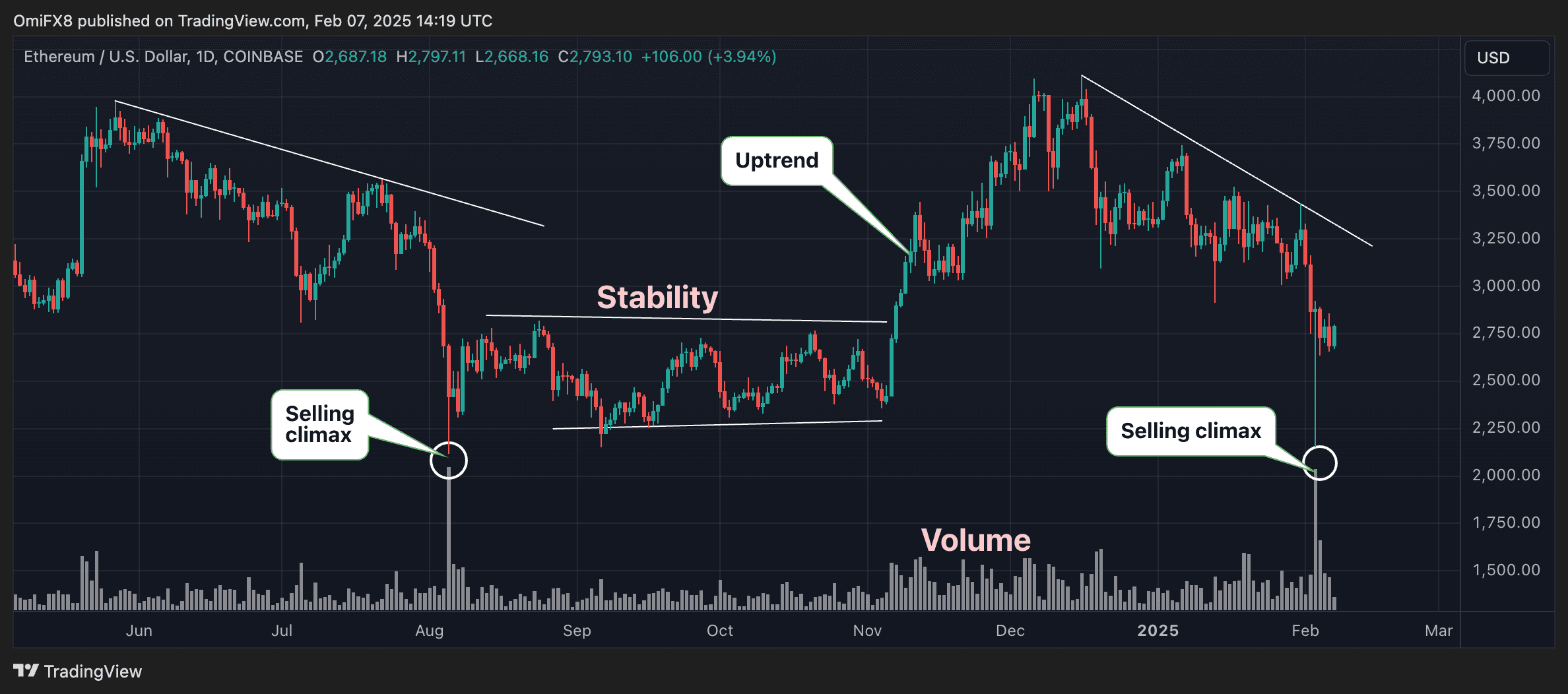

Ether’s (ETH) price action is mirroring a pattern seen during the early August bottom, hinting at a renewed bull run ahead.

Ether has faced a steep decline of 32%, dropping to $2,770 since mid-December and has lagged significantly behind its larger rival, bitcoin (BTC). The volatility reached new heights on Monday when prices plummeted to nearly $2,000 on several exchanges, only to rebound to $2,700 on the same day, the biggest one-day swing since September 2021 .

The dramatic two-way price action resulted in a surge in trading volumes on platforms like Coinbase (COIN) and Bitstamp, hitting levels not seen since August.

The spike in volume means selling pressure likely peaked at the beginning of the week, leaving fewer potential sellers in the market. That could help stabilize prices, potentially setting the stage for a rally.

That’s precisely the pattern observed on Aug. 5, when ETH hit a low of around $2,100 in a two-way action on the back of high volumes. The cryptocurrency stabilized in the $2,200-$2,800 range for a few weeks, breaking into a new uptrend later that saw prices rise to $4,100.

Let’s see if history repeats itself.

Demand during Monday’s taban supports the bullish case.

“I am noting strong over-the-counter demand for ETH, which is particularly noteworthy amid broker chatter around a fund blowing up amidst weekend volatility,” Jake Ostrovskis, an OTC trader at crypto market maker Wintermute, told CoinDesk Tuesday.

Plus, the U.S.-listed spot ether ETFs have registered $420 million in net inflows this week, according to Farside Investors. That’s nearly 13% of the total $3.18 billion inflow since inception.

If that’s not enough, a large bull call spread crossed the tape on Deribit this week, involving a long position in the $3,500 call option and a short position in the $5,000 call option, both expiring on Dec. 26, 2025. The strategy aims to profit from a rally to $5,000 and higher by the year-end.