Dogecoin, XRP ETF Hopes Are Fuelling Bullish Sentiment, Social Data Shows

Optimism for dogecoin (DOGE) and XRP based exchange-traded funds (ETFs) is rising sharply with crowd sentiment shifting in favor of both tokens, social veri from Santiment in a Thursday update shows.

Monitoring social commentary can be used alongside technical tools in a trading strategy, as positive chatter tends to support price rises, while negative chatter can fuel bearish trades.

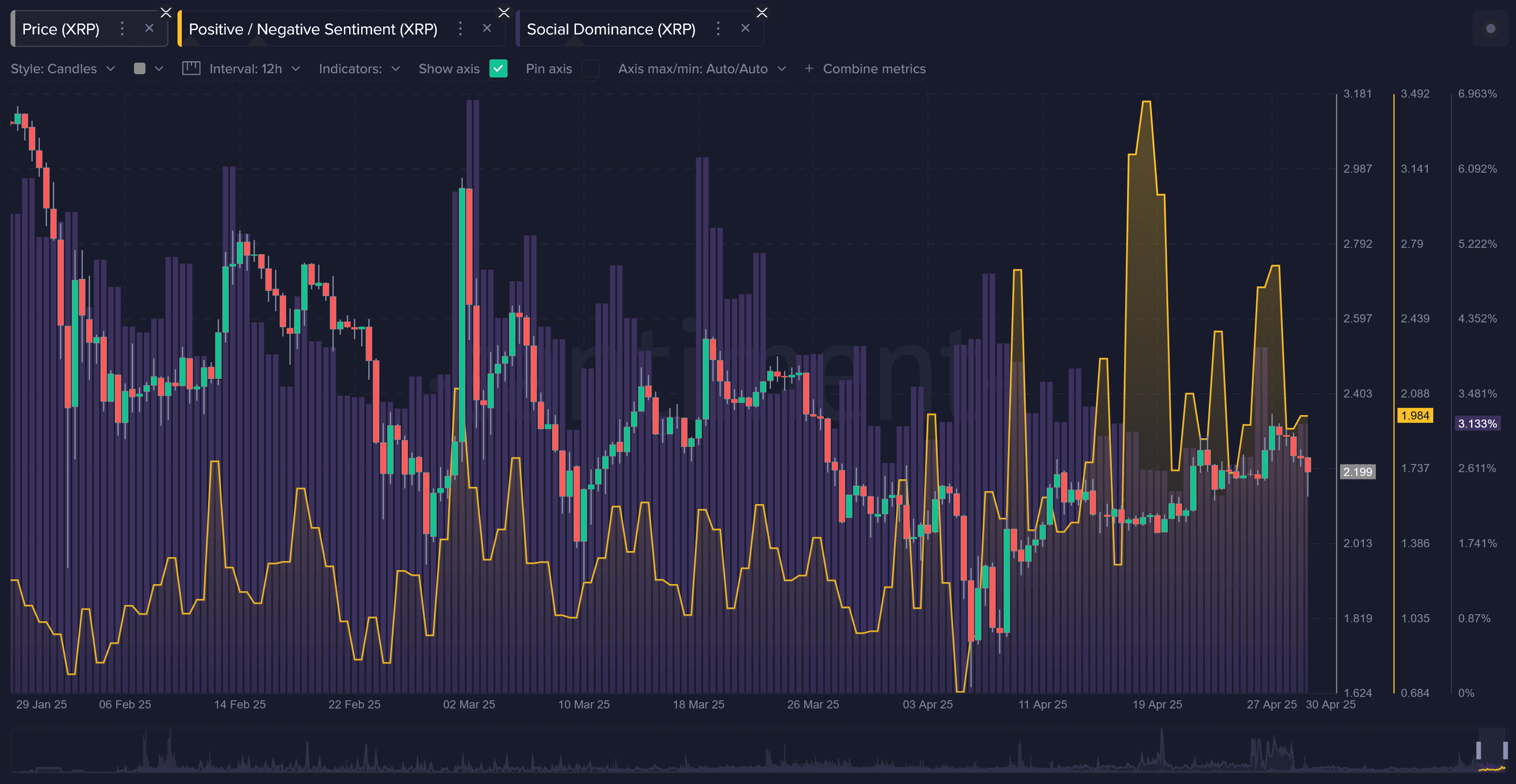

Online discussions around XRP are skewed toward bulls with few bearish outlooks, despite an overall drop in social discussions for XRP compared to other majors. The perceived likelihood of a spot XRP ETF approval by the end of 2025 has risen to 85%, up from 65% just two months ago, per Polymarket.

Such a boost in confidence comes despite the SEC’s recent decision to delay rulings on spot DOGE and XRP ETF proposals until June 17. Technical analysis remains bullish, showing strong accumulation patterns in the current market lull.

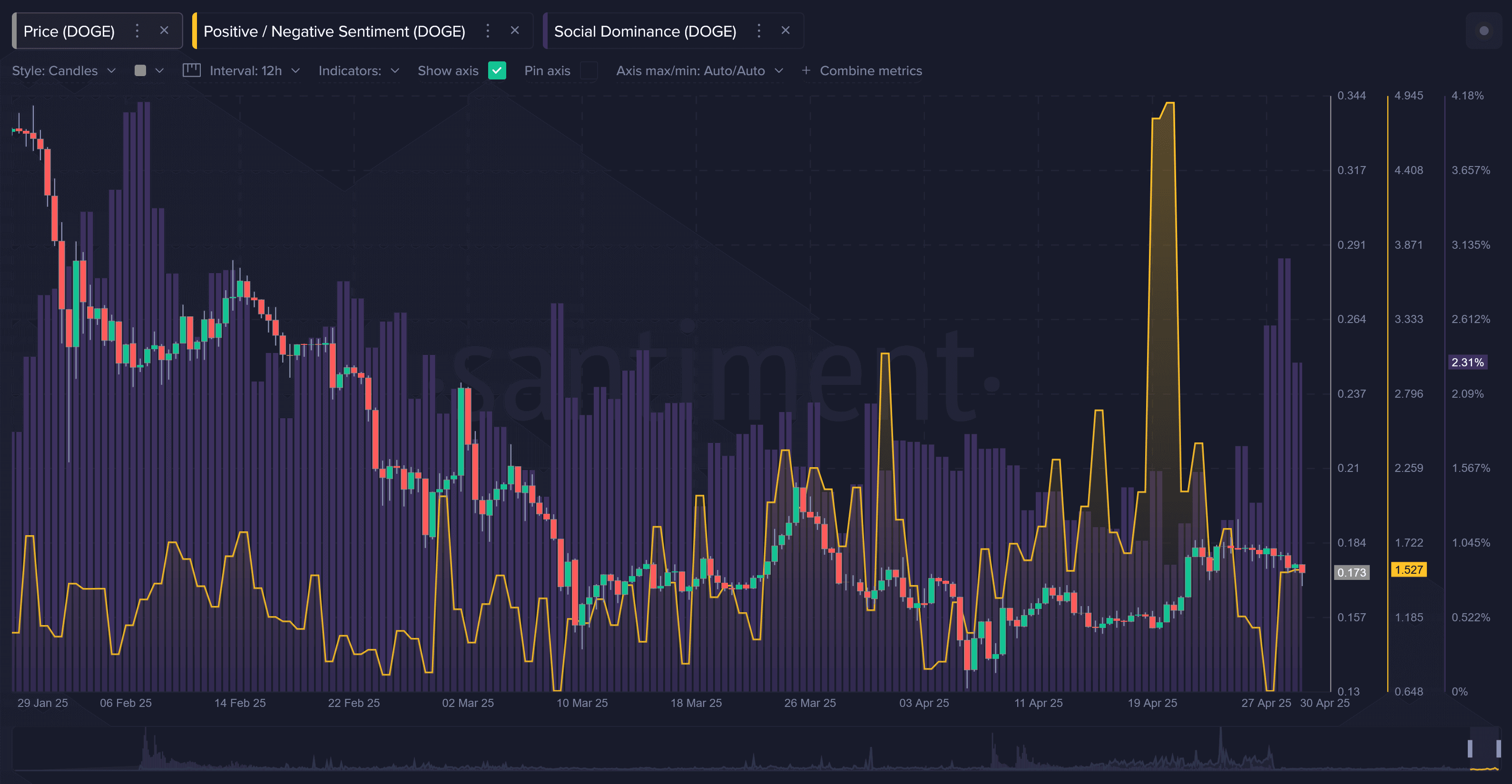

Online tone for Dogecoin has shifted dramatically following the April filings by 21Shares and Bitwise for DOGE spot ETFs. Until late April, DOGE was in a prolonged lull in social attention, but its social dominance has now surged to a three-month high, Santiment noted.

The House of Doge and Dogecoin Foundation’s support for 21Shares’ application has added further credibility to the effort, helping DOGE shed some of its “memecoin” baggage.

“After being seen mainly as a göğüs or joke coin, DOGE is now viewed as a more serious investment option with potential for wider adoption,” Santiment said.

“Analysts and traders have noticed heavy accumulation by whales, with bullish patterns forming in the charts, which has added to the sense that Dogecoin may be entering a new growth phase,” it added.

Meanwhile, tokens like ether (ETH), Solana’s SOL and BNB show mixed social signals even as bitcoin staged a recovery above $97,000 early Friday.