XRP’s 90 Cents Calls Dominate Options Markets as Prices Hover Near 65 Cents: Godbole

XRP’s nascent options market listed on Deribit shows growing bullish sentiment among traders.

At press time, the 90 cents call option was the most popular, with over 5.6 million contracts worth $3.6 million active or open, according to veri source Amberdata. Most of the so-called open interest was concentrated in the Nov. 29 expiry.

A 90 cents call represents a bet that prices would rise above that level. A call option gives the holder the right but not the obligation to purchase the underlying asset at a pre-decided price at a later date. A call buyer is implicitly bullish on the market.

Additionally, a notable open interest is seen in call options at strikes $1.00 and $1.10 expiring on Dec. 27, a sign the rally is expected to continue well into the year-end.

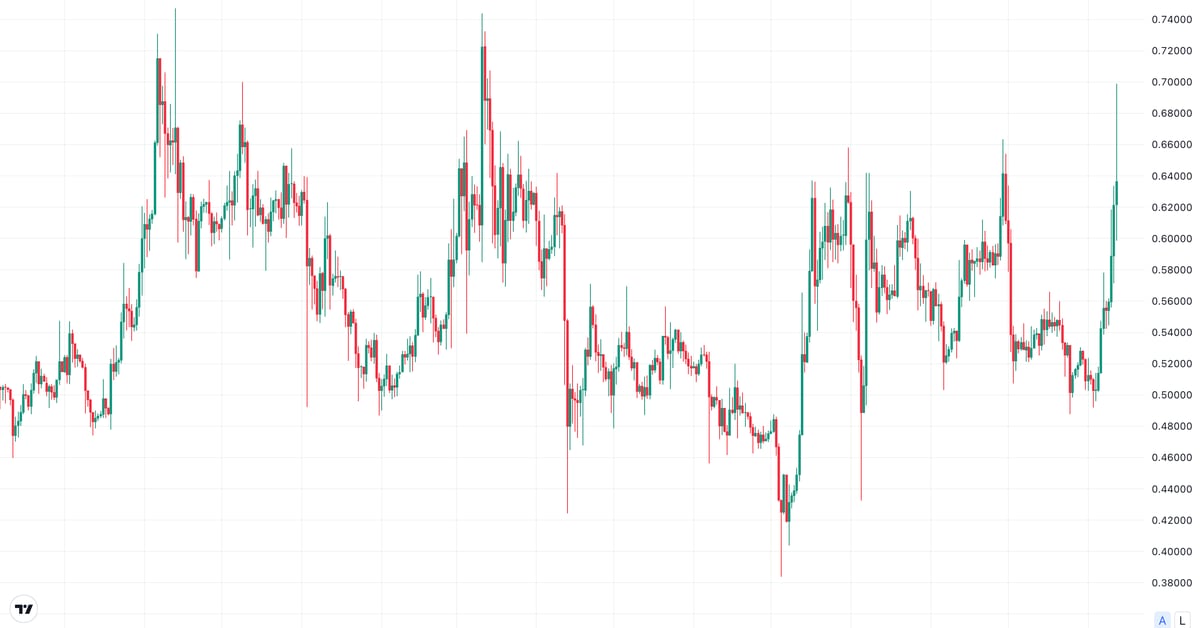

As of this writing, XRP traded close to 65 cents – a critical level above which selling pressure has remained robust since October 2023. Should the resistance give away this time, the months of pent-up energy accumulated during this consolidation phase could be unleashed, potentially yielding a rapid rise toward 90 cents-$1.00.