Bitcoin Tops $91K as Trade Optimism Fuels Crypto Rally But Demand Headwinds Remain

Bitcoin (BTC) surged past $91,000 on Tuesday, climbing nearly 5% amid renewed investor optimism and fresh hopes of a thaw in U.S.-China trade tensions, but headwinds persist that could cap further upside, analytics firm CryptoQuant cautioned.

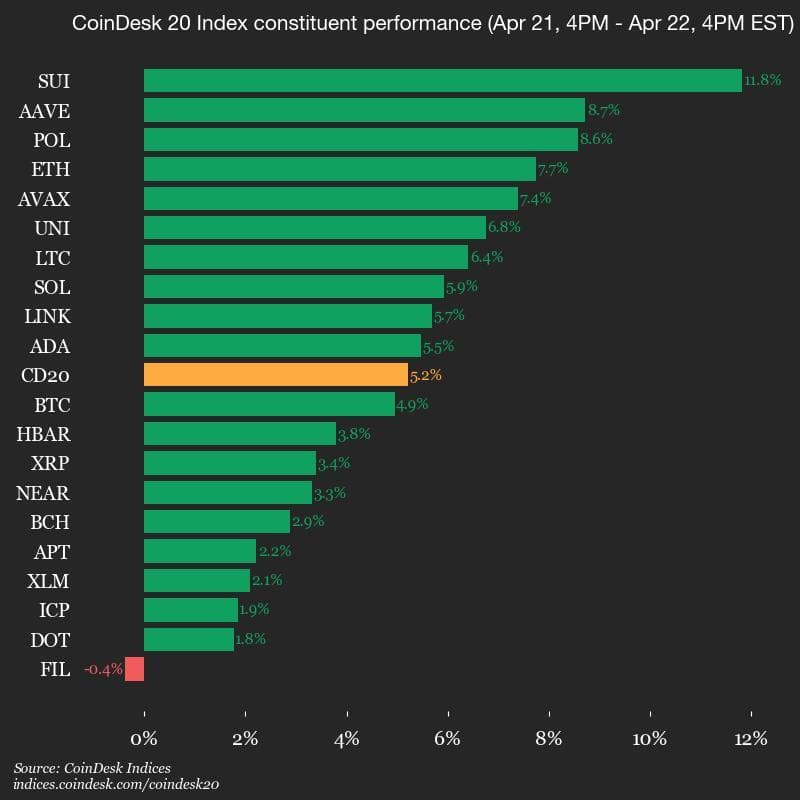

The largest crypto by market capitalization hit $91,700 in the U.S. afternoon, its strongest price since early March. Altcoins followed BTC higher, with Ethereum’s ether (ETH) rising 8% over the past 24 hours above $1,700, and dogecoin (DOGE) and Sui’s native token (SUI) gaining 8.6% and 11.7%, respectively. The broad-market crypto benchmark CoinDesk 20 Index advanced 5.2%.

Markets were buoyed by remarks from U.S. Treasury Secretary Scott Bessent, who reportedly told investors at a closed-door JPMorgan event that the tariff standoff with China was unsustainable. Bessent said de-escalation would come “in the very near future,” characterizing current conditions as a “trade embargo.” However, he cautioned that a more comprehensive deal between the two nations could take even years.

Stocks recovered from yesterday’s decline, with the S&P 500 and the tech-heavy Nasdaq finishing the session 2.5% and 2.7% higher, respectively. Gold, meanwhile, sharply reversed from its record price of $3,500 during the day and was down 1%.

“As capital rotates into safe-haven and inflation-hedging assets, BTC and gold are proving to be key beneficiaries of the exodus from USD risk,” analysts at hedge fund QCP Capital said in a Telegram broadcast.

They highlighted rejuvenating inflows to spot U.S.-listed BTC ETFs and the return of the so-called Coinbase price premium, suggesting demand from American institutional investors. BTC ETF booked over $381 million net inflows on Monday adding to Thursday’s $107 million, according to Farside Investors veri.

But not all signs point to a sustained breakout.

Despite the price jump, on-chain veri points to fragility beneath the surface, CryptoQuant analysts said in a Tuesday report. Bitcoin’s apparent demand has decreased by 146,000 BTC over the past 30 days—an improvement from the sharp drop in March, but still negative. CryptoQuant’s demand momentum metric, which tracks new investor interest, has deteriorated further to its the most bearish level since October 2024, the report noted.

Market liquidity remains soft, with the report using USDT’s market cap growth as a proxy for crypto liquidity. USDT grew $2.9 billion over the past two months, below its 30-day average. Historically, BTC rallies coincided with USDT growth above $5 billion and above trend — a threshold not yet met.

Adding to the caution, bitcoin is now facing a key resistance zone between $91,000 and $92,000 at around the “Trader’s On-chain Realized Price” metric, a level that has often served as resistance in bearish conditions. CryptoQuant’s on-chain bull score classified current market conditions as bearish, suggesting a pause or pullback could follow if sentiment weakens.