Tariff Fallout Slaps Ether Bulls With Looming $100M Liquidation

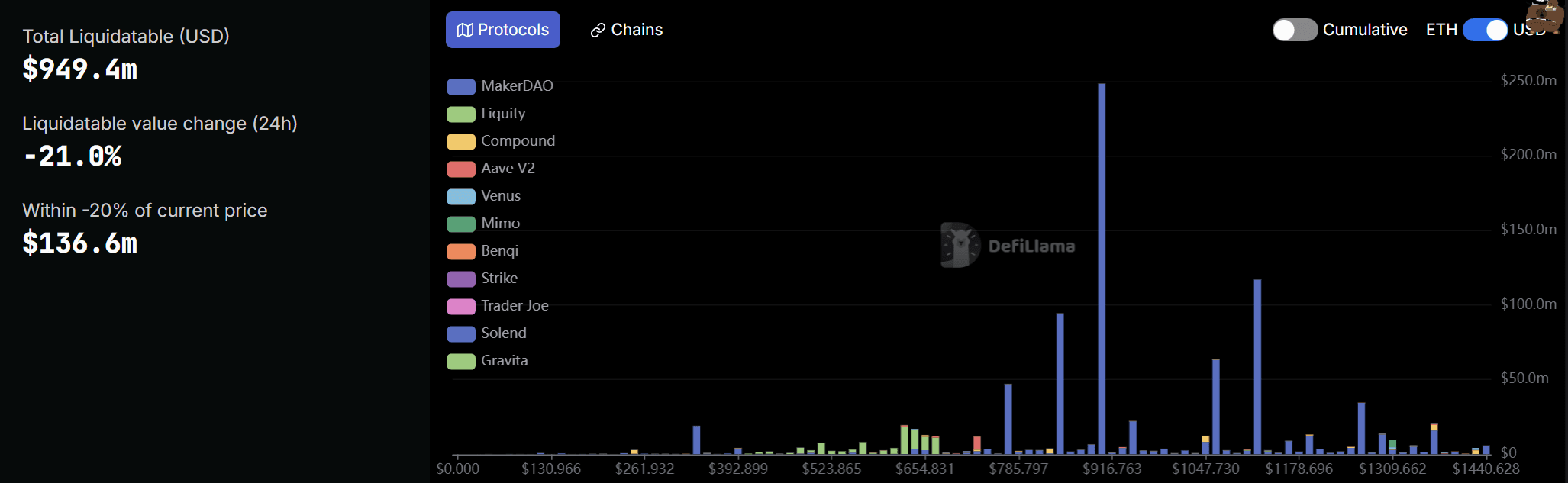

Analysis of on-chain veri curated by DefiLlama shows that nearly $100 million in ether (ETH) positions are at risk if the price slides by 15%.

Traders in Asia faced a sea of red during the Monday business day as the ripple effects of U.S. President Donald Trump’s tariff policy were felt around the world.

ETH is down nearly 16% Monday, according to CoinDesk veri, now trading above $1490, while the CoinDesk 20 index is down 13%, and market participants fear that the U.S. open could bring more pain.

Should the U.S. open bring another 15% drop in ETH’s price, sending it below $1,274, more than $100 million in leveraged positions could face imminent liquidation.

On-chain liquidations are potentially more impactful than those related to derivatives as it involves spot assets being sold onto the market. In MakerDAO’s case, a liquidated position is auctioned off at a cheaper rate to traders who can then sell at a relative premium, flooding the market with supply and creating more sell pressure.

One wallet which would get liquidated at $1418 had a number of close calls Monday but trimmed its holdings of ETH and paid back repaid some of the DAI it owed.

DeFiLlama veri also shows that should the price of ETH sink by 20%, another $36 million is at risk.

The largest single ETH position, with $147 million in collateral locked, has a strike price of $1,132.

Lending protocols were some of the hardest hit tokens during the Monday Asia trading day, with CoinGecko veri showing that the category is down 17% on-day as concern grows about the health of levarage around some positions.