SEC Dropping Coinbase Case Could Boost Robinhood Stock, Tokens Alleged as Securities

The Securities and Exchange Commission (SEC) potentially dropping its Coinbase lawsuit could help boost sentiment for not only crypto tokens that were alleged as securities under the last presidential administration but also popular exchange Robinhood’s (HOOD) shares.

While the SEC hasn’t officially voted on the Coinbase case, it will likely be welcomed by the industry that has faced enforcement by the agency under the Joe Biden administration. Robinhood was one of the exchanges that had to delist all of the tokens that were alleged to be securities in June 2023. However, after President Donald Trump won the U.S. presidential election last year, the exchange added back some of those tokens, including Solana’s SOL, which the SEC alleged were securities.

With the Coinbase case set to be dropped, exchanges such as Robinhood feel less risk in adding more tokens to their platform, potentially increasing trading revenue. Most recently, the popular crypto platform said its fourth-quarter revenue rose 115% from the previous year, topping Wall Street’s estimates, mainly boosted by a rise in crypto trading revenue.

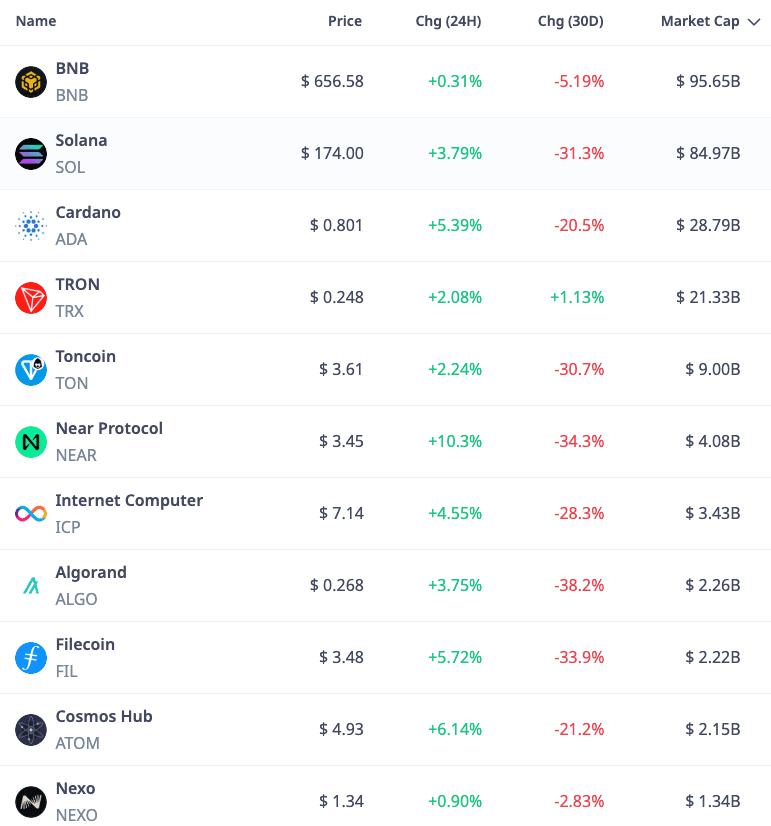

According to Cryptorank.io, the top five tokens, based on market cap, that were alleged securities include BNB, Solana (SOL), Cardano (ADA), Tron (TRX) and Toncoin (TON).

The move might also encourage more companies to list their firms publicly in the U.S. markets. Several crypto companies are already rumored to be considering initial public offerings (IPOs) in the U.S., including Blockchain.com, BitGo, Gemini, EToro, Bullish Küresel (CoinDesk’s parent company), Ripple and Circle.