Bitcoin’s Coinbase Premium Indicator Shows Overseas BTC Buyers Taking the Lead Ahead of CPI Release

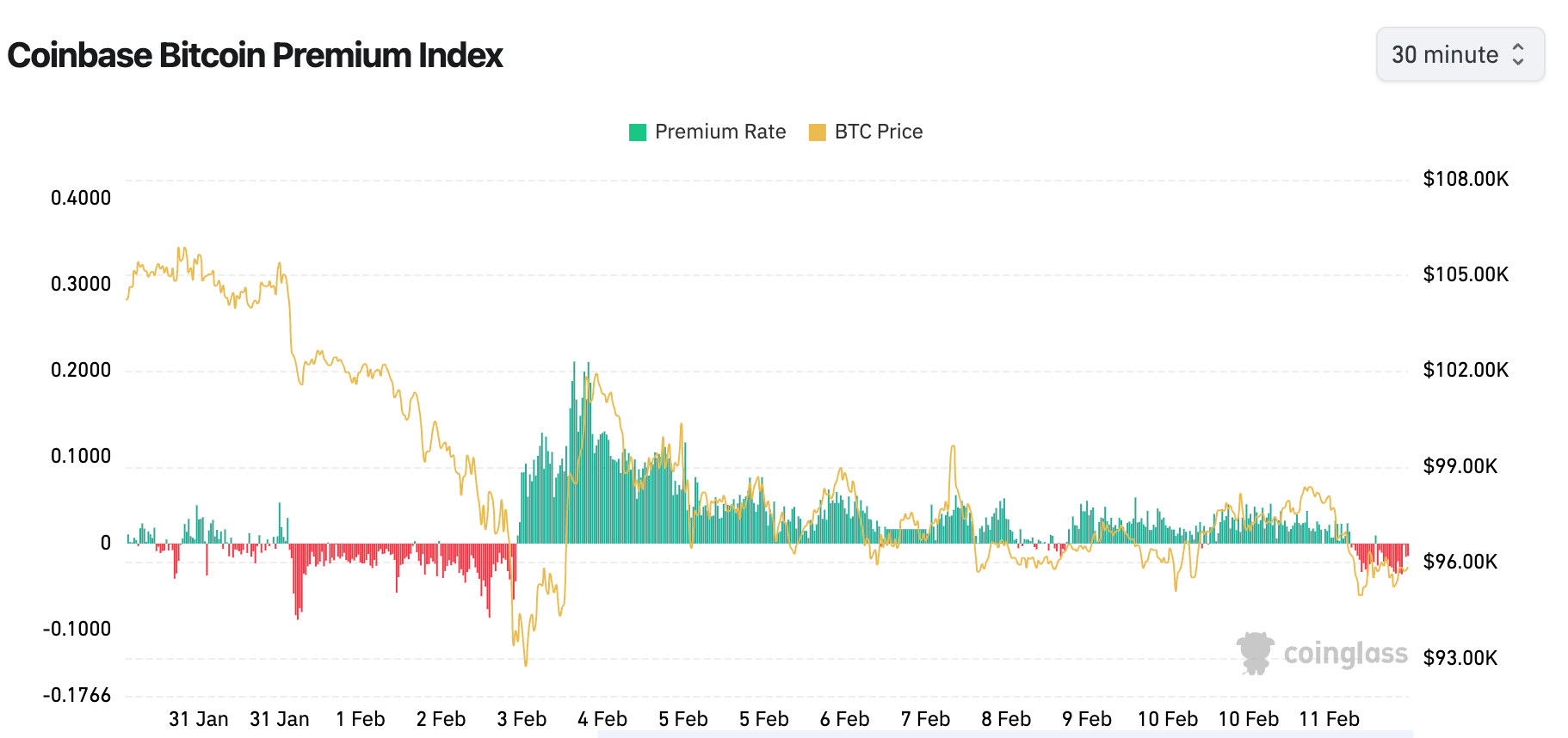

Bitcoin’s (BTC) Coinbase premium indicator, which measures the spread between BTC’s dollar-denominated price on the Coinbase exchange and tether-denominated price on Binance, has flipped negative for the first time since the Feb. 3 crash, according to veri source Coinglass.

It’s a sign that traders over the Nasdaq-listed exchange have turned cautious ahead of Wednesday’s U.S. CPI release, and their offshore counterparts have led the price recovery from overnight lows near $94,900 to $96,000.

Historically, bull runs have been marked by prices trading at a premium on Coinbase, indicating strong leadership from U.S. investors. The premium soared to two-month highs in early November as BTC rose into its the-then uncharted territory above $70,000.