Bitcoin Prices Take Breather as BTC ETFs Record Another Day of Monster Inflows

Bitcoin (BTC) markets saw profit-taking over the past 24 hours after a strong week in which the largest cryptocurrency posted a seven-day gain of almost 8%.

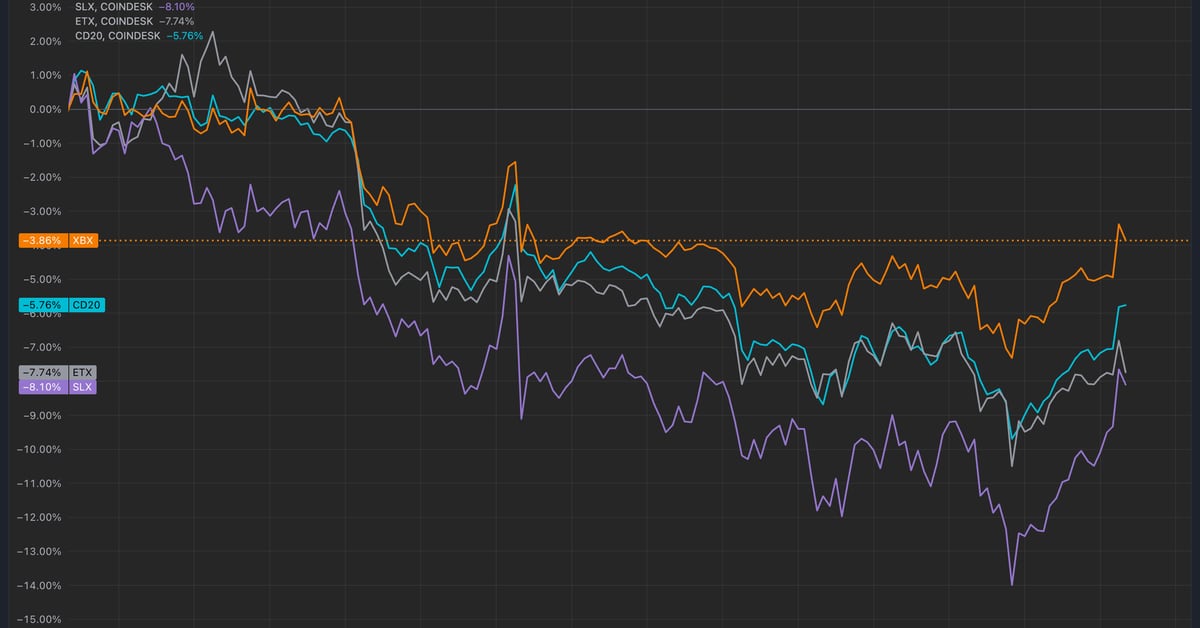

BTC fell as much as 0.5% before recovering to just over $72,400 during the European morning. It rose as high as $73,200 in early Asian morning hours Wednesday. Major tokens posted losses with Solana’s SOL and BNB Chain’s BNB falling as much as 2.5% while dogecoin (DOGE) dropped 1% after several days of outperformance.

The broad-based CoinDesk 20 (CD20), a liquid index of the largest tokens by market capitalization, lost 1.3% in the past 24 hours.

A breather in the market from a wider pump earlier in the week came amid a second straight day of strong inflows for U.S. bitcoin exchange-traded funds (ETFs). The ETFs recorded over $893 million in inflows on Wednesday after taking in $879 million on Tuesday, the first back-to-back inflows of more than $850 million. Cumulative net inflows since their introduction in January now total $24 billion, according to veri tracked by Farside Investors.

BlackRock’s IBIT accounted for most of Wednesday’s flows, attracting a record $872 million.

Other ETFs posted inflows under $12 million, while Bitwise’s BITB was the only product with net outflows, losing $23.9 million.

The net inflows are a sign of institutional demand as bitcoin’s dominance continues to grow, traders said.

“Strong BTC net inflows indicate robust institutional demand as BTC dominance continues to rise (59.8%) at the expense of ETH,” Augustine Fan, head of insights at DeFi platform SOFA, told CoinDesk in a Telegram message. “BTC has outperformed ETH by nearly 10% on a week-on-week basis.

“Equities are trading with a distinctive ‘Trump-win’ flavour despite official betting odds still calling for a 50–50 race. Similar positive skews can be observed in gold and crypto prices with call skews being bid up post-election as a hedge,” Fan wrote.

Skew refers to the shape of the distribution of returns for a financial asset. Positive skew in an options market context, such gold and cryptocurrency prices, indicates that there’s an increased demand for call options relative to put options. This means more investors are buying options betting on the price of the asset to go higher.